Back to December 2024 Industry Update

December 2024 Industry Update: Truckload Demand

Truckload volumes weakened in November and have yet to reflect the beginning of peak retail shipping season.

Key Points

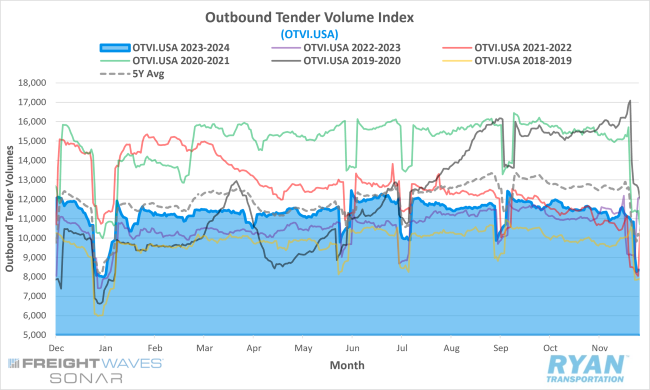

- Looking at mid-month comparisons to remove disruptions from the holiday, the FreightWaves SONAR Outbound Tender Volume Index (OTVI.USA), a measure of contracted tender volumes across all modes, registered a 4.5% decline MoM at the mid-way point in November compared to 30 days prior, dropping from 11,536.51 in October to 11,016.90.

- The monthly average of daily tender volumes in November declined by 5.9% MoM compared to October, falling from 11,622.99 to 10,942.88.

- Compared to November 2023, average daily tender volumes were up 0.8% YoY and registered 10.2% below the 5-year average.

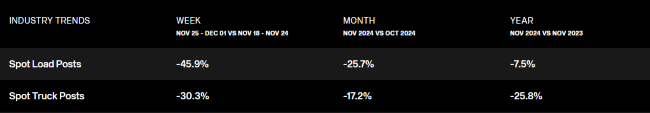

- After surging in October, spot market volumes declined in November, dropping 25.7% MoM and registering 7.5% below November 2023 levels.

- The Cass Freight Index Report, which analyzes the number of freight shipments across North America and the total dollar value spent on those shipments, registered MoM increases for both shipments and expenditures of 0.5% and 0.9%, respectively, in November with both remaining lower compared to 2023 by 0.7% and 3.8%, respectively.

Summary

Truckload demand, which demonstrated resilience throughout the first three quarters of the year, appears to have softened in the fourth quarter. Tender volumes, as tracked by the FreightWaves SONAR Outbound Tender Volume Index (OTVI), weakened over the past two months. Following a 2.5% MoM decline in October, average tender volumes fell further in November by nearly 6%, reaching their lowest levels since May. While a seasonal downturn in demand is typical in November compared to October, the 5.9% MoM decline in November's average tender volumes exceeded the historical seasonal decline of just over 4% for the month. Adjusting for the typical lull in freight activity associated with Thanksgiving, mid-month comparisons reveal a 4.5% MoM decline—significantly outpacing the historical average decline of 0.6% for this period.

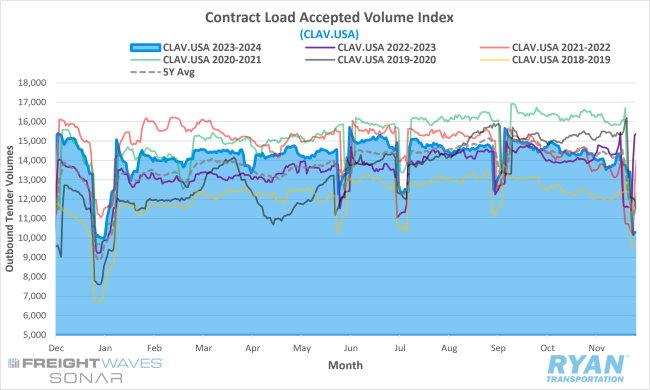

Despite these monthly decreases, tender volumes in November remained slightly elevated on a YoY basis compared to 2023. However, the positive YoY trend narrowed significantly. After achieving a 4.9% YoY increase in October, OTVI volumes were only 0.8% higher YoY in November. Notably, the YoY gains reflected in the OTVI include tender rejection rates, which were substantially higher this year compared to the same period last year. When excluding tender rejections—an adjustment captured by the FreightWaves SONAR Contract Load Accepted Volume Index (CLAV.USA)—accepted tender volumes in November were 1.6% lower YoY, marking the first time this index fell below the prior year's levels since October of last year.

The softening of demand was not limited to the contract market, as spot market volumes also faced challenges in November. After gaining momentum in October due to disruptions caused by hurricanes and a port strike, spot market volumes experienced consistent declines throughout November. According to DAT load post data, total load postings dropped by a cumulative 15.3% over the first two full weeks of the month. Although volumes rebounded in the third week with a 12% WoW increase as shippers expedited shipments ahead of the holiday, they plunged by approximately 46% WoW in the shortened week leading up to Thanksgiving, reflecting the typical holiday-related slowdown in freight activity.

Why It Matters:

The continued decline in overall volumes during Q4, particularly during the traditional peak retail season, raises concerns about the timeline for the industry's recovery from the recession. Historically, November presents two distinct demand phases: a subdued first half, followed by a surge in the latter half as the retail peak season gains momentum. However, this year, the expected late-season demand uplift has yet to materialize, with demand levels remaining largely stagnant or slightly declining over the past two months.

Several theories have been proposed to explain the sluggish start to the peak season. A primary explanation attributes the slowdown to the pull-forward of imports and shipments earlier in the year, as shippers sought to mitigate potential disruptions from the ILA strikes. This aligns with the elevated volume levels observed in August and September. Supporting this theory, the November Logistics Managers’ Index highlights increased inventory costs despite overall lower inventory levels.

This suggests that while there is less inventory in the system compared to October, a higher proportion of inventory is concentrated in high-cost locations closer to consumers. This indicates that products have already progressed through warehouses and are near the final stages of the supply chain. Additional factors include the continued growth of private fleets, which are absorbing volumes traditionally handled by the for-hire market, as well as the impact of Thanksgiving occurring later in November this year. Although there have been isolated signs of improvement in freight demand, these gains have largely been limited to specific regions or seasonal trends.

While growth in goods demand has bolstered freight volumes for much of the year—evidenced by sustained strength in imports, intermodal activity and freight GDP—the persistent weakness in the industrial sector has impeded a full market recovery. Looking ahead, the anticipated rebound in the manufacturing sector in early 2025, driven by expected interest rate cuts and the pro-business agenda of the incoming administration, is expected to provide the final impetus needed for the market to achieve equilibrium.

However, concerns remain regarding the potential impact of tariffs on major trading partners and the looming January deadline for the International Longshoremen’s Association (ILA) master contract extension. Analysts have projected that the proposed tariffs under the Trump administration could result in a 1% increase in PCE inflation, as many businesses have indicated they would pass these costs on to consumers. This development could complicate the Federal Reserve’s efforts to further reduce interest rates. While tariffs have featured prominently in the agendas of the past two administrations, it is worth noting that the initial U.S.-China trade war, which began in mid-2018, contributed to the industry recession of 2019. Conversely, the tax cuts of 2018, which spurred a freight boom, align with the policy direction of the new administration.

Regarding ongoing labor negotiations between the U.S. Maritime Alliance (USMX) and the ILA, the master contract extension is set to expire on January 15. This raises the possibility of a port strike along the East and Gulf Coasts. While the October work stoppage was limited to three days, it is unlikely the ILA will agree to another extension if negotiations remain unresolved. That said, the incoming administration may adopt a more employer-friendly stance, potentially invoking the Taft-Hartley Act to mandate the resumption of operations, which could strengthen the USMX’s position in negotiations.

Ultimately, there are clear indications of progress and plenty to be optimistic about for the eventual conclusion of the current recession. However, there are still a number of potential headwinds that could prolong the soft demand environment, leaving the outlook overshadowed with uncertainty.