Back to December 2024 Industry Update

December 2024 Industry Update: Truckload Rates

Average spot rates rose slightly while contract rates remained flat as the contract-to-spot spread narrowed further in November.

Spot Rates

Key Points

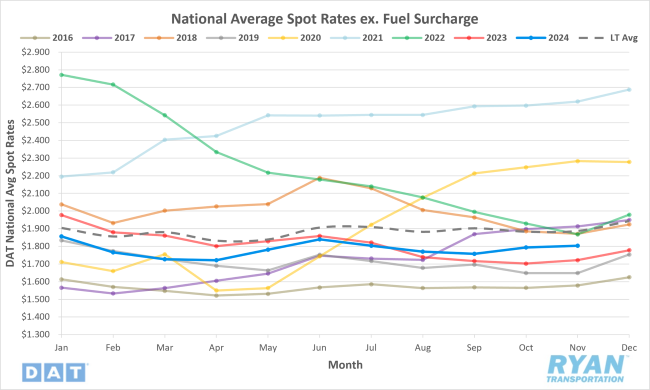

- The national average spot rate, excluding fuel, increased slightly in November by just under $0.01 MoM, or 0.5%, to $1.80.

- Compared to November 2023, average spot linehaul rates were up 4.7% YoY but remain 4.5% below the long-term (LT) average.

Contract Rates

Key Points

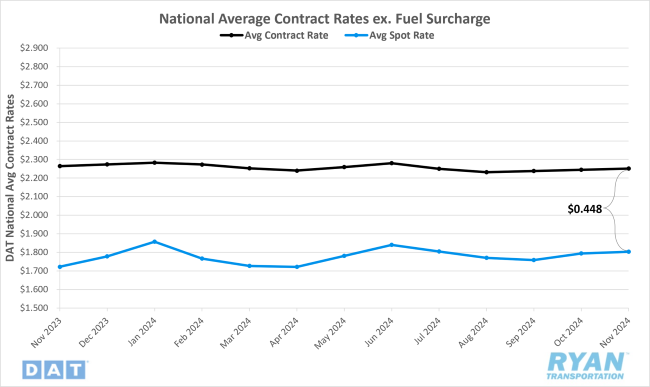

- Initially reported average contract rates excluding a fuel surcharge were essentially flat MoM in November, rising by 0.03% to just over $2.25.

- On an annual basis, average contract linehaul rates were down 0.6% YoY compared to November 2023.

- The contract-to-spot spread fell by less than $0.01 from $0.451 in October to $0.448 in November.

Summary

The national average spot rate, excluding fuel, increased slightly in November, marking its second consecutive month of growth as the peak retail shipping season commenced. While the rise was modest, the 0.5% MoM increase aligns with the typical seasonal average for November of 0.2%. November also marked the fourth consecutive month of average spot linehaul rates exceeding 2023 levels. Although the YoY gap narrowed slightly—from 5.4% in October to 4.7% in November—the sustained elevation of current rates compared to the previous year suggests that pricing is beginning to recover from prior lows.

Weekly data from the DAT 7-Day Linehaul Spot Rate Index indicates that average spot rates were initially moderated in the first half of November before posting marginal yet steady increases in the latter half. After beginning the month with a modest WoW gain of just over $0.01, rates dipped back to late October levels during the second week. However, gains resumed in the latter half of the month, with the index rising by over $0.03, driven largely by increases during Thanksgiving week. By the end of November, 7-day average linehaul rates were $0.07 higher YoY and $0.12 above the same week in 2019.

Meanwhile, average contract rates, excluding fuel, remained nearly flat on a MoM basis in November, consistent with the trend observed over the past two months. The minimal MoM fluctuations, averaging less than 0.1% throughout the year, indicate that opportunities for further discounts have likely been exhausted. On an annual basis, YoY comparisons for average contract linehaul rates turned slightly negative in November, declining by 0.6% after briefly surpassing the previous year’s levels in October by 0.8%. While this does not reflect improvement on a monthly basis, the narrower YoY decline represents the smallest negative differential since September 2022 (-0.1%). As in the spot market, the continued narrowing of YoY comparisons suggests that contract rates are beginning to rebound from their previous lows.

Why It Matters:

Spot rates aligning with seasonal patterns in November provide further evidence that the market, from a pricing perspective, is exhibiting signs of normalization. The absence of a correction following October's unseasonal spike in rates suggests that demand seasonality for the peak holiday shipping period contributed to stabilizing rates in November. However, the ongoing issue of excess capacity continues to challenge the sustainability of long-term rate growth. Looking ahead, capacity disruptions expected between Christmas and New Year’s may introduce greater volatility in the spot market during December. Historically, average spot rates experience a modest MoM increase of just over 3% in the final month of the year.

The sustained YoY improvement in average spot rates compared to 2023 is an encouraging signal, indicating the market is recovering from the current cycle's low point. While contract rates remain slightly below last year’s levels, they are increasingly vulnerable to upward pressure driven by continued spot rate growth. Although the stabilization of rates in both spot and contract markets provides a welcome reprieve from the depressed conditions of the past two and a half years, a full pricing recovery remains a long-term objective.

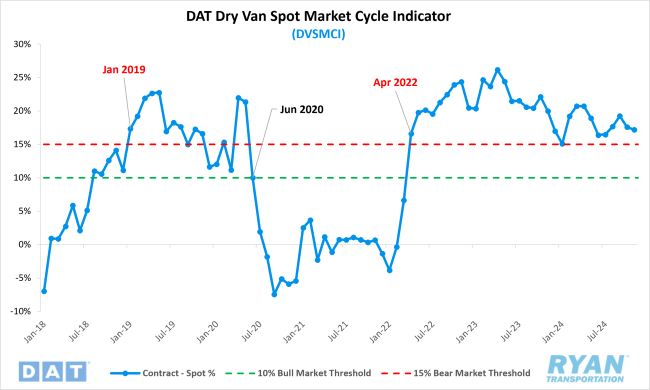

According to the DAT Dry Van Spot Market Cycle Index (DVSMCI), which measures the spread between spot and contract rates relative to their average, November recorded a reading of 17.2%, a slight improvement from October's 17.6%. Nonetheless, the index remains in bear market territory. As noted by Professor Jason Miller, Interim Chair of Supply Chain Management at Michigan State University and creator of the index, a ratio above 15% signals bearish market conditions, while a ratio below 10% is indicative of a more bullish environment.

Looking forward to 2025, considerable uncertainty surrounds rate trends due to various factors influencing the transportation industry. While there is broad consensus among analysts that rates will increase over the next year, the timing and magnitude of growth remain subjects of debate. Some projections suggest growth could begin as early as Q2, aligning with anticipated manufacturing expansion, while others expect increases to materialize in the latter half of the year. Forecasted growth ranges widely, from low-to-mid single digits to as much as a 20% increase by the end of 2025. Although pricing tailwinds outweigh headwinds, rate increases are expected to be gradual, barring significant weather events or macroeconomic disruptions.