Back to November 2024 Industry Update

November 2024 Industry Update: Truckload Rates

Average spot rates rose in October and outpaced smaller gains in the contract market, dropping the contract-to-spot rate spread back within the pre-pandemic average range.

Spot Rates

Key Points

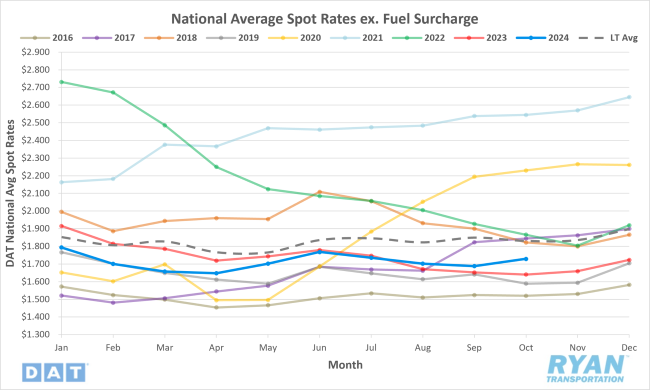

- The national average spot rate excluding fuel increased 2.4% MoM, or $0.04, in October to $1.73.

- Compared to October 2023, average spot linehaul rates were 5.4% higher YoY but remain 5.6% below the long-term (LT) average.

Contract Rates

Key Points

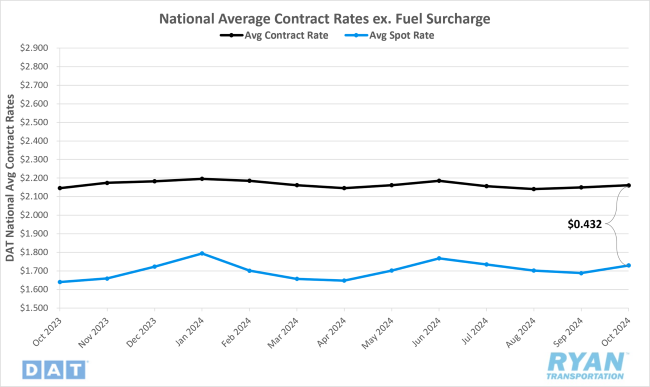

- Initially reported average contract rates excluding a fuel surcharge increased slightly by 0.6% MoM, or just over $0.01, in October.

- On an annual basis, average contract linehaul rates were 0.7% lower YoY compared to October 2023.

- The contract-to-spot spread declined by just under $0.03, dropping from $0.462 in September to $0.432 in October.

Summary

After three consecutive months of declines, national average spot rates rebounded in October, surpassing typical seasonal expectations for this period. October saw a 2.4% MoM increase, outperforming the average seasonal decline of 1.1% for October and the pre-pandemic average decrease of 1.5%. With the rise in average linehaul spot rates, the gap between current rates and the long-term average narrowed for the first time since June. Having reached its lowest point of the year in September at 8.8% below the average, the spread decreased by $0.06 MoM to finish October just 5.6% below.

According to weekly data from the DAT 7-day Linehaul Spot Rate Index, average spot rates moderated throughout October. After opening the month slightly lower from where they ended September, the DAT index recorded consecutive WoW gains in the second and third weeks, totaling $0.03. However, the gains stalled in the final week as average spot rates fell slightly by just under $0.01 but remained 1.3% above where they started the month.

In the contract market, initially reported average linehaul contract rates saw a modest MoM increase in October, marking the second consecutive month of gains. The $0.01 MoM increase in October kept average contract rates within the narrow range observed throughout 2024. The average monthly fluctuation in contract rates to date remains at $0.002, following October’s increase. Annual comparisons have also shown improvement, with the YoY differential turning positive for the first time since August 2022. As the rise in average spot rates outpaced contract rate gains, the contract-to-spot spread narrowed from $0.462 in September to just over $0.43 in October, returning to the pre-pandemic average range.

Why It Matters:

The increase in average spot rates in October was atypical, as this period generally experiences a seasonal decline. However, this rise was not unwarranted. Relief efforts following Hurricane Helene and the impact of Hurricane Milton’s early October landfall served as key drivers for the uptick in the spot market. Although Hurricane Milton’s effects were less severe than expected, the disruption to capacity and routing guides contributed to a temporary boost in national spot rates. Nonetheless, many analysts view this increase as a short-term lift, unlikely to stimulate a lasting recovery in freight rates.

Despite limited near-term expectations for sustained rate growth, October’s increase in spot rates was still noteworthy. A modest correction following the early-month boost helped stabilize average spot rates as the industry moves into the peak holiday shipping season. While excess supply continues to outpace demand, demand seasonality will likely exert some upward pressure on spot market conditions as Thanksgiving approaches. This seasonal surge, combined with the elevated baseline in spot rates, could lead to more substantial rate gains through the year-end.

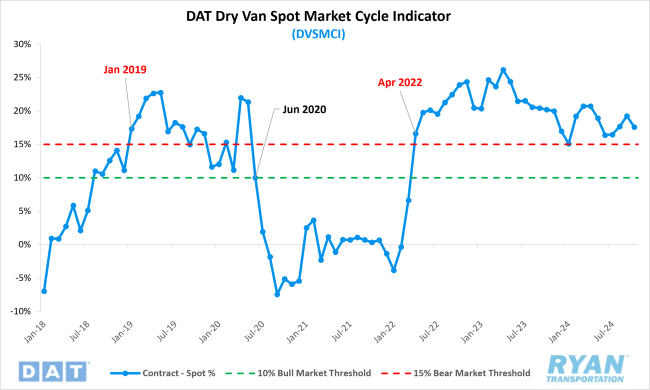

Encouragingly, the sustained YoY growth in average spot rates compared to 2023 indicates a recovery from bottom of the current cycle. Initial contract rates also turned positive on an annual basis, suggesting that pressure from shippers for rate concessions has largely subsided. The DAT Dry Van Spot Market Cycle Indicator (DVSMCI), which measures the spread between spot and contract rates relative to their average, dropped from 19.3% in September to 17.6% in October. According to Jason Miller, Interim Chair of Supply Chain Management at Michigan State University, who developed this index, a ratio above 15% denotes a bear market while a ratio below 10% implies a more balanced market. Although October’s reading remains in bear market territory, the MoM decline in the index suggests a movement toward equilibrium as the peak shipping season approaches.