Back to September 2024 Industry Update

September 2024 Industry Update: Truckload Demand

Freight volumes remained stable in August, registering slightly higher compared to July and providing a solid base ahead of the pre-holiday peak shipping season.

Key Points

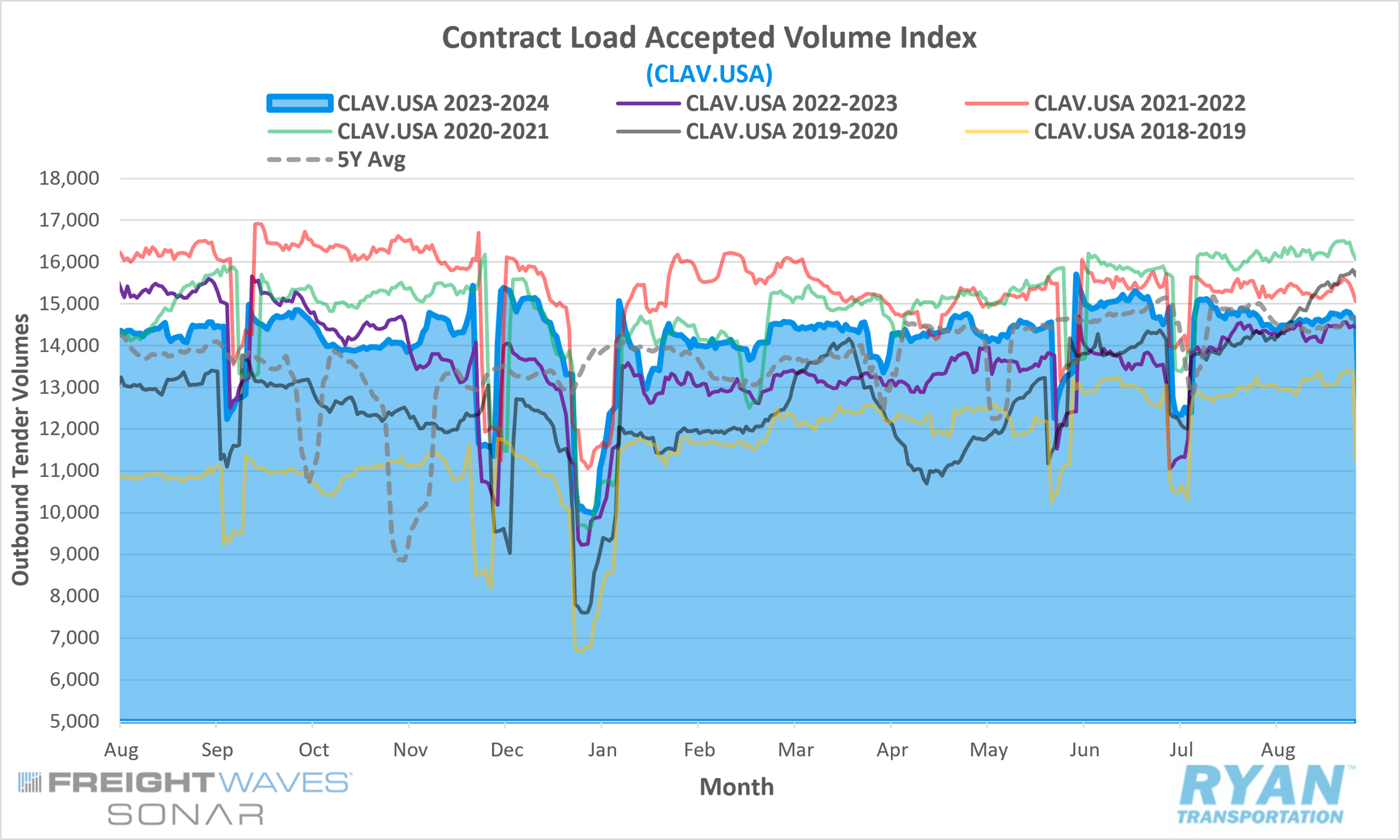

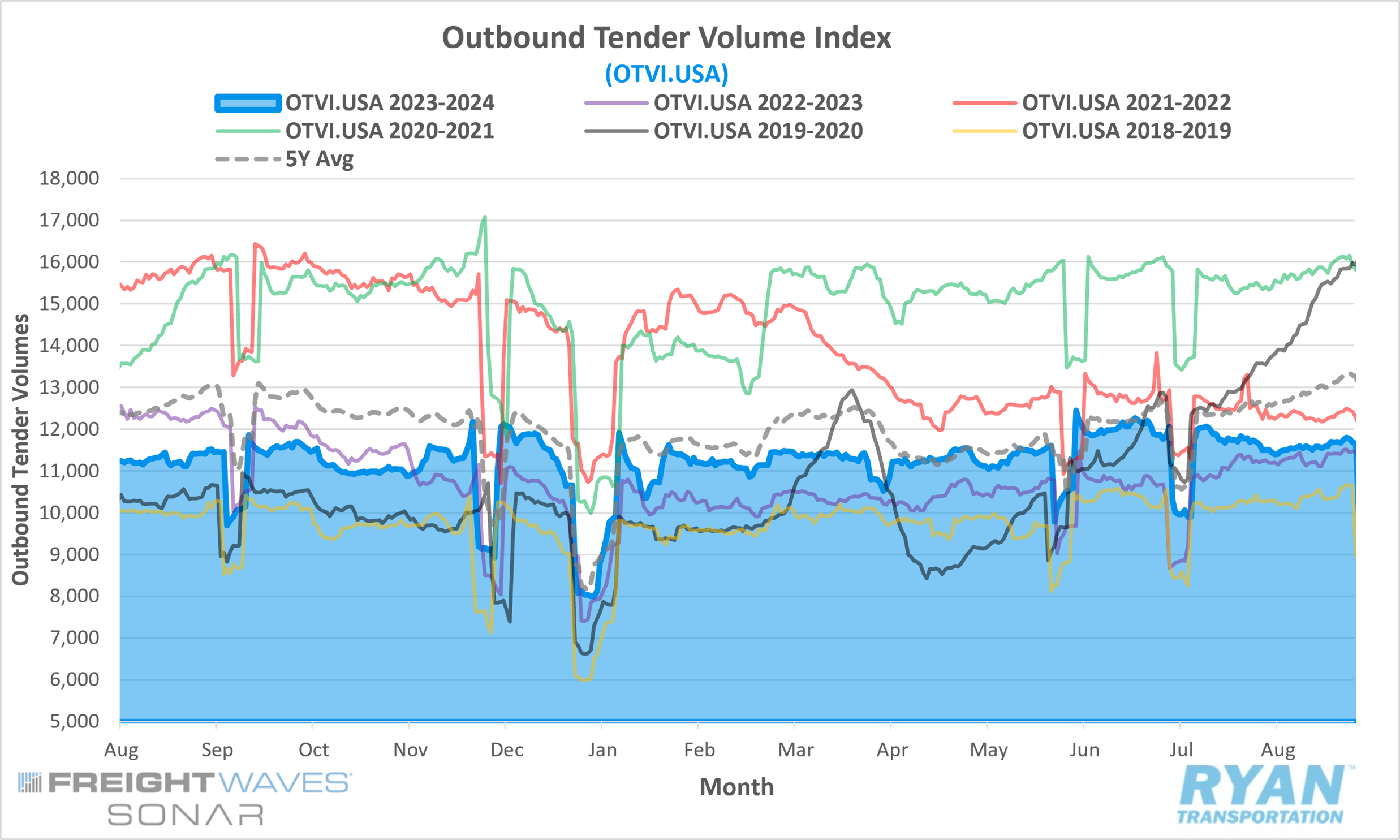

- The FreightWaves SONAR Outbound Tender Volume Index (OTVI.USA), a measure of contracted tender volumes across all modes, was virtually flat MoM at the end of August compared to 30 days prior, dropping less than 0.1% from 11,700.40 at the end of July to 11,690.80.

- The monthly average of daily tender volumes in August was 1.4% higher MoM compared to July, rising from 11,423.27 to 11,582.55.

Compared to August 2023, average daily tender volumes were up 2.6% YoY but were 10.1% below the 5-year average.

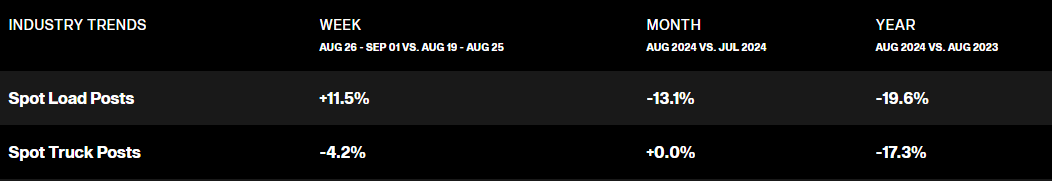

- Spot market volumes continued to deteriorate in August, with spot activity falling 13.1% MoM and registering 19.6% lower compared to August 2023.

- The Cass Freight Index Report, which analyzes the number of freight shipments in North America and the total dollar value spent on those shipments, increased on a monthly basis in July for both shipments and expenditures by 3.0% and 0.7%, respectively, while both remained below YoY levels by 1.1% and 6.2%, respectively.

Summary

Following consistent declines in the latter half of July after the post-Fourth of July holiday slowdown, freight volumes, as recorded by the FreightWaves SONAR Outbound Tender Volume Index (OTVI), showed signs of stabilization in August. However, this improvement was not immediate; the downturn from July extended into early August, with the OTVI registering a decrease of approximately 3% WoW in the first week of the month. The negative trend paused after the initial week, leading to moderate WoW increases for the remainder of August, resulting in an overall gain of just over 2%. While the daily average of outbound tender volumes in August was marginally higher, the data is skewed due to the reduced activity observed around the Fourth of July holiday and subsequent days. Despite the month ending with levels slightly below those seen at the end of July, the tender volume index remains elevated YoY as freight demand continues to outperform 2023 levels.

Typically, seasonal trends suggest a decline in freight volumes in July compared to June. However, the Cass Freight Index reported a 3% increase in North American shipments during July. This growth was also reflected by a 0.3% seasonally adjusted rise in the American Trucking Association's (ATA) Truck Tonnage Index, as well as and increases of 0.7% and 1.5% in the DAT Truckload Volume Index for dry vans and reefers, respectively, on a MoM basis. While the strength in demand indicated by these reports is positive for the overall economy, it has not translated into increased opportunities within the for-hire sector. According to a recent benchmarking survey by the National Private Truck Council (NPTC), which represents companies operating private fleets across various sectors, private fleets now manage 75% of outbound volumes for member companies, up from the 60% average observed in recent years.

The stability of the contract market and the increased utilization of private fleets continue to come at the expense of spot market participants. August saw further declines in spot market volumes on both a monthly and annual basis. In the final week of August leading up to Labor Day, there was some momentum in the spot market as volumes surged nearly 12% from the previous week's levels. However, this increase did not offset the overall poor performance during the month, resulting in spot market volumes reaching their lowest level since August 2017, according to DAT.

Why It Matters

While the stable demand observed in August offers a solid foundation for freight volumes as we approach the peak pre-holiday shipping season, several challenges are tempering growth expectations for the remainder of the year. Foremost among these is the ongoing weakness in domestic manufacturing, which we have highlighted previously. With inventories increasing due to slower-than-expected sales, coupled with the elevated cost of capital and uncertainty surrounding the upcoming election, manufacturers are scaling back investments in materials, consequently reducing truckload demand.

Another significant factor impacting the outlook for truckload volumes is the continued expansion of private fleets. Shippers are increasingly opting to use their own fleets instead of for-hire trucking companies as part of a strategic effort to strengthen control over their supply chains. In 2024, the increase in outbound shipments managed by private fleets has already removed a substantial amount of volume from the already oversaturated for-hire trucking sector. Furthermore, companies remain focused on efficiency, leading to a growing share of inbound shipments being retained on in-house tractors, further diminishing opportunities for external for-hire carriers.

The surge in spot market volumes during the final week of August was a positive indicator of the return of seasonality, and a potential precursor to upcoming holiday activity. Additionally, there have been regional instances of tightening capacity around key distribution hubs such as Allentown, PA, Charlotte, NC and Atlanta, GA, which were likely driven by robust import activity. However, as noted earlier, much of this import volume has not yet translated into significant increases for truckload or domestic rail carriers. It remains uncertain whether the bulk of these imported containers have already been transported inland via international intermodal carriers, or if they are still awaiting breakdown and conversion into surface or rail volumes. Should the latter be the case, there may be a near-term uptick in volume activity for truckload carriers ahead of peak holiday shipping, particularly in light of the impending port strikes along the East and Gulf coasts.